April is Tax Month, and businesses and nonprofits are always looking for opportunities to save money in this high inflationary season, especially when it comes to taxes.

This month, we’re privileged to have Michael Hanf, CPA, Partner, and ERC Practice Lead at William Vaughan walk through the benefits of the Employee Retention Tax Credit (ERTC) established under the CARES Act.

ERTC is a refundable tax credit employers can claim against certain employment taxes, and can potentially provide immense capital from which to operate.

According to Hanf, “With a maximum credit of $7,000 per employee, per quarter, a business eligible (for the ERTC) for all three quarters of 2021, could receive refunds of $21,000 per employee. Without question, the ERTC can provide much-needed dollars for eligible employers.”

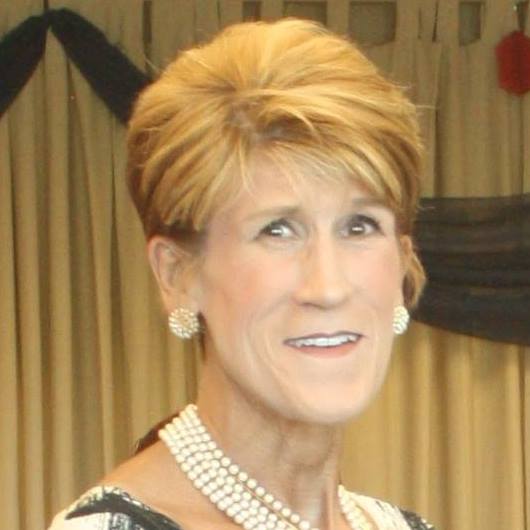

Bio | Michael L. Hanf

Partner & Construction Practice Leader @William Vaughan Company

Mike Hanf is a partner with William Vaughan Company with more than 27 years of experience advising entrepreneurs, family-owned businesses, and Fortune 1000 entities on a wide range of tax planning and business matters. His vast knowledge of tax regulation allows him to deliver solutions that fit his clients’ needs and position them for the future. In addition to consulting on tax and accounting issues, Mike has vast experience addressing the broader business matters that drive sustained value. Prior to joining William Vaughan Company, Mike founded DHC, LLC, where he spent 13 years advising a wide range of clients on financial and business matters. In addition, he devoted 10 years of his career serving clients at Ernst & Young.

RESOURCES:

PowerPoint Presentation